The California small estate affidavit is a formal document used to collect the estate of a person who died while living in California. This affidavit is only valid depending on the worth and nature of the estate. Different procedures exist in California to transfer the small estate property to the decedent's spouse or children without prolonged formal administration.

However, the affidavit for collection of personal property California follows the 13100 affidavit probate code for the small estate. This affidavit saves time, effort, and hassle for the inheritors.

California Laws and Requirements

The tiresome probate proceedings for California were ease in California Probate Code section 13100-13116. This section has paved the way for the small estate affidavit California. The successors will file a probate form 13100 affidavit to transfer the inherited property with the individual or organization that has custody of the property. The following section details out the laws and requirement for the eligibility of the small estate affidavit:

- Time Limit: The waiting time of 40 days is required after the deceased's death to apply for the affidavit.

- State Determinant Worth: The total worth in the dollar value of the assets must not exceed $165,250, and the value of the real estate property is limited to $55,425.

The valuation of the property must be a meticulous process. The following are some guidelines on what sort of property is not part of the affidavit:

- Any real estate property outside California won’t be included.

- The movable property such as a vehicle, boat, or mobile homes will be excluded.

- The unpaid wages or other money owed to the person who died up to $5,000.

- Jointly owned assets would be outside of the affidavit jurisdiction. This also includes the bank accounts and other property.

- Community property will be directly transferred to the surviving spouse or partner and excluded from the affidavit.

- Life insurance, retirement accounts, death payments, and other properties that flow automatically to the beneficiaries are not subject to probate.

- Debts or mortgages owed by the deceased.

After observing the criteria mentioned earlier, the successor in interest will initiate the small estate affidavit if applicable.

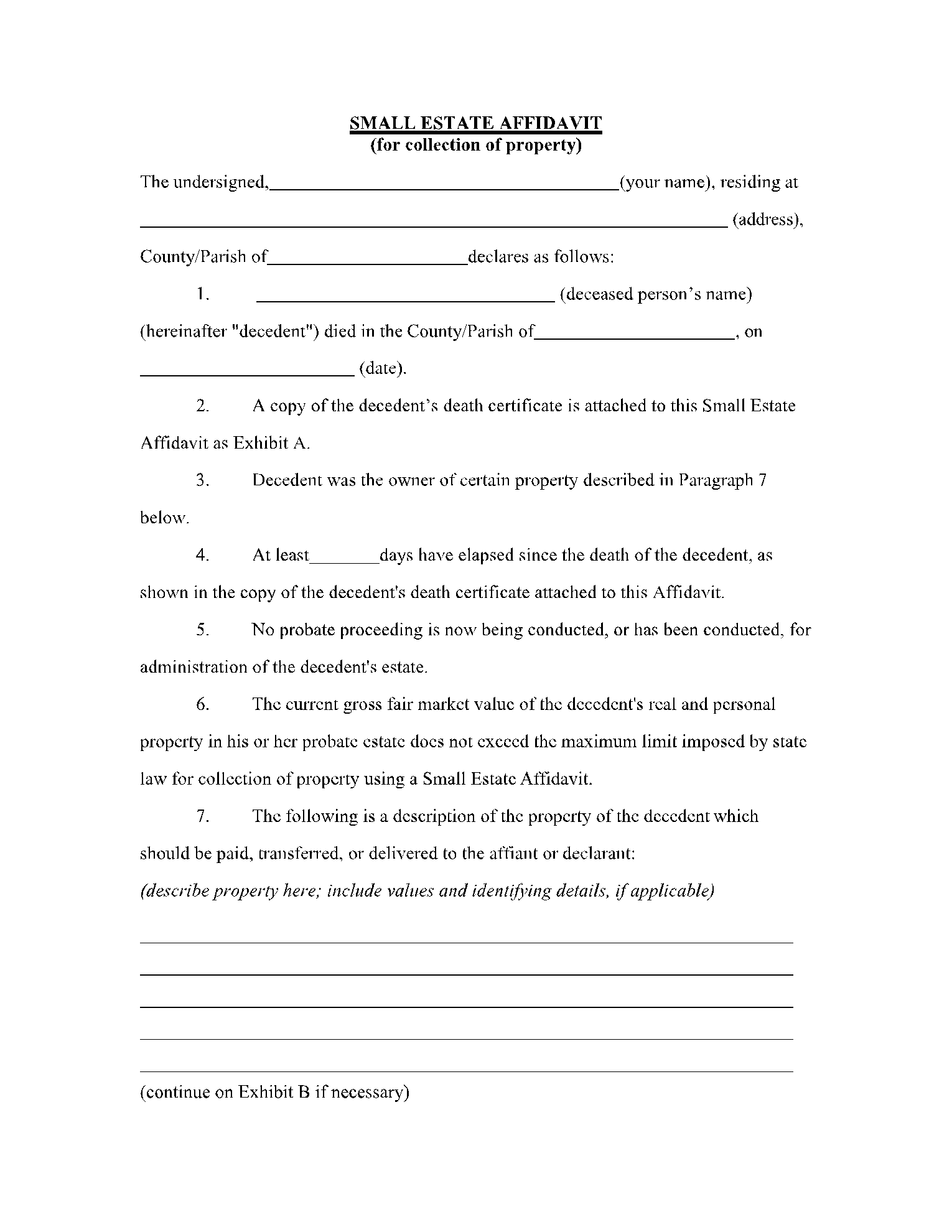

Typical Format of A Small Estate Affidavit in California

The format of the small estate affidavit California must be thorough and fulfill all the requirements by the state. The following sections key the basic layout of the affidavit:

- The name of the deceased person. Also, the date and place of the death.

- A declaration that the decedent has been dead for at least 40 days. This can be shown by a valid copy of the decedent's death certificate.

- The name of the decedent's successor to the specified property. It can include a spouse, children, or other family members.

- The detailed worth of the decedent's assets in California that they do not surpass the limit. This must not include the excluded property.

- A list of the deceased's property must be compensated, sold, or transferred to the affiant or declarant.

- Section to address that no probate proceeding has been initiated in the California state.

- The declaration that the provided information is valid and accurate. In case of falsified information, the affiant will be served under the penalty of perjury.

How to File a Small Estate Affidavit in California

The filling of the small estate affidavit California must follow the precise process. It is a legally binding proceeding, so every step must be followed. The affidavit may be filed by taking the steps below:

- Procure and Complete the Affidavit: The California small estate affidavit can be obtained through the county's probate court or can be downloaded from the online court's self-help center. Users can also access CocoDoc for filling out the specific small estate affidavit. The completion of the form must be done by following the directions on it.

- Required Attachments: The affidavit must be filled in accompanied by few documents. The following documents must be attached to the affidavit of a small estate:

- A valid copy of the deceased person's death certificate.

- Proof of the land ownership of the deceased. They include registered paper, bank statements, storage receipts, stock certificates, etc.

- Identification document of the affiant. It can be a passport, state ID, driving license, or other.

- Prepare a list of all the real property of the decedent in California if any. This information will be listed in the Inventory and Appraisal form. Before attaching this document, have it signed by a probate referee at the court.

- Obtain Additional Signatures: The party should have a signed affidavit in case someone else is entitled to the mentioned property of the decedent. It will declare their agreement to inherit the assets to the affiant.

- Notarized the Proceeding: It will be best to notarize the form even if it isn't a requirement of the state of California. The document will be submitted to the property holding financial institutions and may require a notarized form.

- Transfer of the Property: Affiant must wait 40 days after the date of death before delivering the affidavit and attachments to any individual or a corporation that owns the property.

Common Mistakes to Avoid When Drafting a Small Estate Affidavit

During any part of the affidavit proceeding, the affiant is subjected to make some mistakes that can harm the process. These mistakes can put hurdles or even stop the transfer proceeding. The following parts explain the most common mistakes that must be avoided:

- Missing Assets: There might be some assets that need some digging to see the light. It includes some valuable jewelry, artwork, or some other item. Collect details of each asset before applying for the affidavit.

- A Miscalculation in Worth: The improper valuation of the property will hinder the affidavit proceedings. Carefully calculate the cost of each item in the dollar value.

- Left Out Inheritors: The signed document of the heirs agreed to transfer the property to the affiant’s name is required. Any inheritor left out of the document can halt the process of the proceeding altogether.

Conclusion

The filling of the small estate affidavit California is a very simplified procedure than probate. A few requirements must be addressed to transfer the property of the decedent effectively. The article has shed light on all the critical aspects of the proceedings and provides a complete guide for the California small estate affidavit process.