The concepts and delays in the process of transferring the assets to the affiant vary in each country. The probate court acts according to their decree laws and decides whether a will is valid or not. The procedure of the court can be complex or straightforward and may take more or less time, respectively.

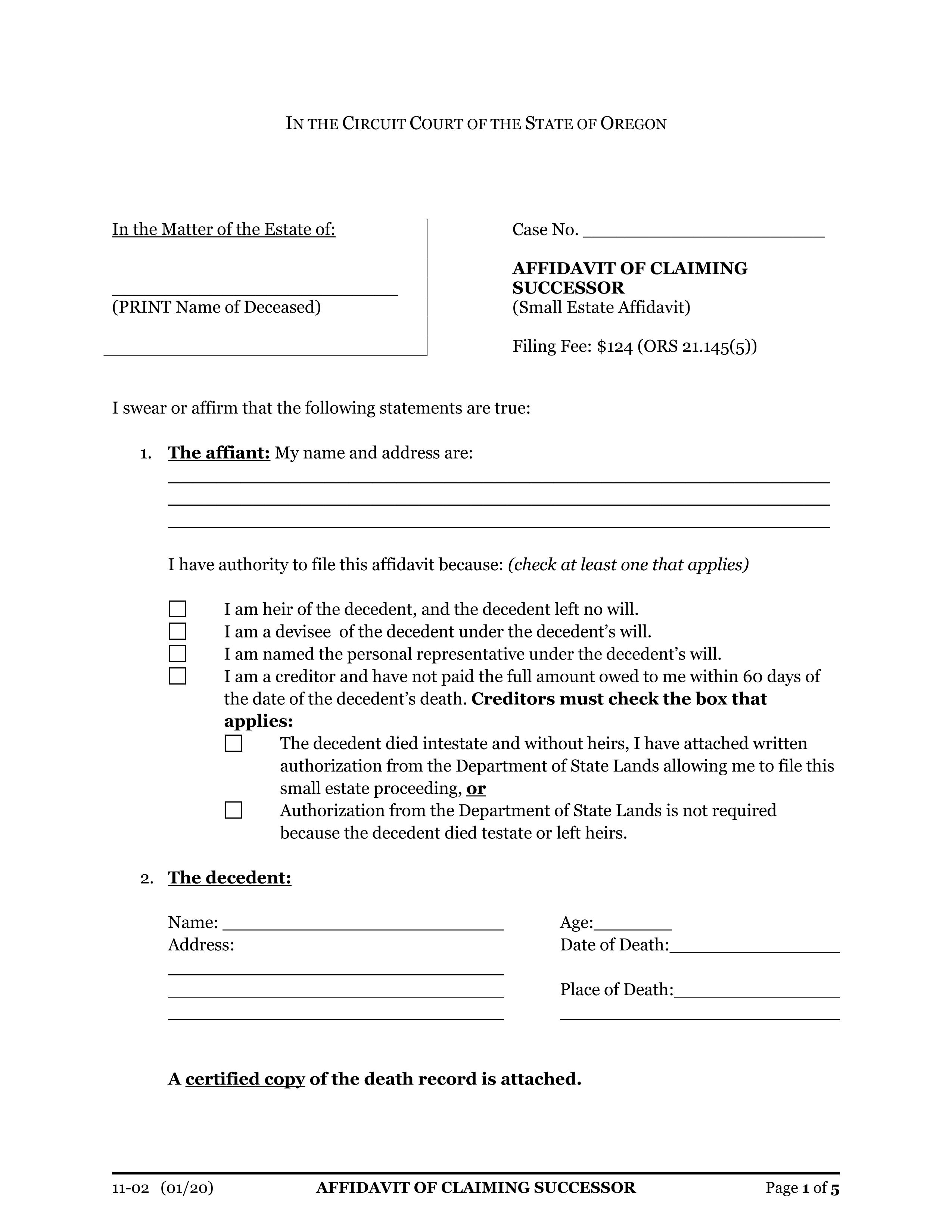

Besides the complexity of the probate court procedure, Oregon state designed its own small estate affidavit. If the amount of assets meets the necessity of the small estate, the state will issue Oregon small estate affidavit to the affiant.

Laws and Requirements in Oregon

Oregon state laws certainly have detailed information regarding small estate affidavit Oregon. The laws of Oregon state have a description about various aspects which are mentioned on their small estate affidavit forms such as:

- Who can file the required documents with the affidavit form?

- Who is responsible for paying the fee while issuing and submitting the affidavit form?

- How much the cost of the decedent assets will be considered as small estate?

- What kind of documents are required to complete the affidavit submission?

The above questions are essential information that every small estate affidavit contains. In Oregon small estate affidavit form, the maximum amount allowed as a small estate is $275,000. The amount required for a small estate could not exceed this, in any case. Whereas the filing fees, according to state laws, is exactly $124.

In Oregon state, all kinds of forms are considered SEA forms. Such forms cover both general property forms and vehicle transfer forms. The form which carries the information regarding the transfer of vehicle is the DMV form. The procedure in the DMV form is about the transfer of vehicle and the change of name and registration to the affiant.

A Simplified Oregon Procedure for Small Probate Assets

Oregon offered a simple probate procedure for small estate affidavit Oregon forms. For using the simplified approach, the affiant needs to request a probate court. It is up to the court to allow the distribution of assets regardless of following lengthy probate procedures.

An affiant will be allowed for short probate procedures if the cost structure of a small estate is no more than $275,000. The small estate Oregon amount is further examined according to personal property and real estate. Private property and real estate should be less than $75,000 and $200,000, respectively.

Moreover, probate proceedings take 30-days to complete. The request made by the affiant to the local court must contain some significant piece of information, as follows:

- Affiant should put all precise information regarding the deceased person, including his social security number, date, and place of death.

- Documents required for submitting the affidavit includes the death certificate and all property-related documents.

- All possible information about the heir and the beneficiary and their relationship with the deceased person.

- Allowance of family members and remaining from child support.

- Debts and taxes according to preferences under the federal law and state law.

- All possible expenses of last illness of decedent.

- Remaining wages before 90 days of death.

- Claims from different departments of Veterans Affairs, Human Services, and Correction.

- Name and address of the deceased person.

- A will of the decedent, if there is any, must be attached with the affidavit.

- All property-related documents having complete information. The assets like investment and bank accounts, insurance policies, and vehicles are also included.

- Name and other details of the creditors against whom the deceased person has any debts, including funeral charges.

- List and each detail including name, age, relationship with the decedent, and addresses of holders of the property stated.

Affiant should also take care of the expenses and claim that he might have to pay against the estate. The claims and expenses could be:

Who Can Take Advantage of Oregon’s Small Estate Affidavit?

Oregon small estate affidavit is an efficient process to manage the long-term procedures in a relatively short period. The lengthy process of probate court hearings can be neglected using these forms. According to Oregon state laws, any family member, blood relatives, or successor can begin this process for the smooth transfer of property.

The transfer of the assets is entirely dependent on the decedent's will if there is any. However, testament or intestacy rules will be applied for distribution in the absence of a will. Asset distribution fluctuates according to the governing laws and inheritors of the assets.

The transfer procedure varies from person to person. In case of any successor and guardian, the assets will be directly transferred by their names. However, for a trustee of the deceased person, the trustee should follow the transfer by affidavit procedure for transferring the property into the trust.

For the distribution of the assets, it should be done efficiently. A simple negotiation procedure will be enough for members to distribute the decided amount of assets between them. Affiant and the trusted party will come up with a fixed amount and will get their inherited property.

How to Fill Out a Small Estate Affidavit Template

The simplified template of Oregon probate forms covers all crucial details required for transferring property in Oregon. The transfer of assets is initiated when the affiant requests the local court for the transfer of property. All further initial procedures are already discussed in the above parts. You can select any small estate affidavits using CocoDoc, an online platform for impressing affidavit templates.

In this part of the article, viewers will know what they need to fill in small estate affidavit forms. The following guidelines are for filling the small estate affidavit forms correctly:

Conclusion

The above article details all the possible information regarding Oregon small estate affidavit forms. These forms have an efficient and simplified procedure for transferring the assets of the decedent estate to the holders by distribution law. Using the given template of a small estate affidavit by CocoDoc, the transfer of assets could be done in an impressive amount of time and cost.