The small estate affidavit Florida is a legal document filed by the successor after the death of the ancestor in the court of Florida. This document is signed to distribute all the assets of the deceased person among the entitled successors.

Florida small estate affidavit is only valid in the cases where the value of the deceased's assets is less than $75,000. Otherwise, other procedures are followed to transfer the assets to the heirs.

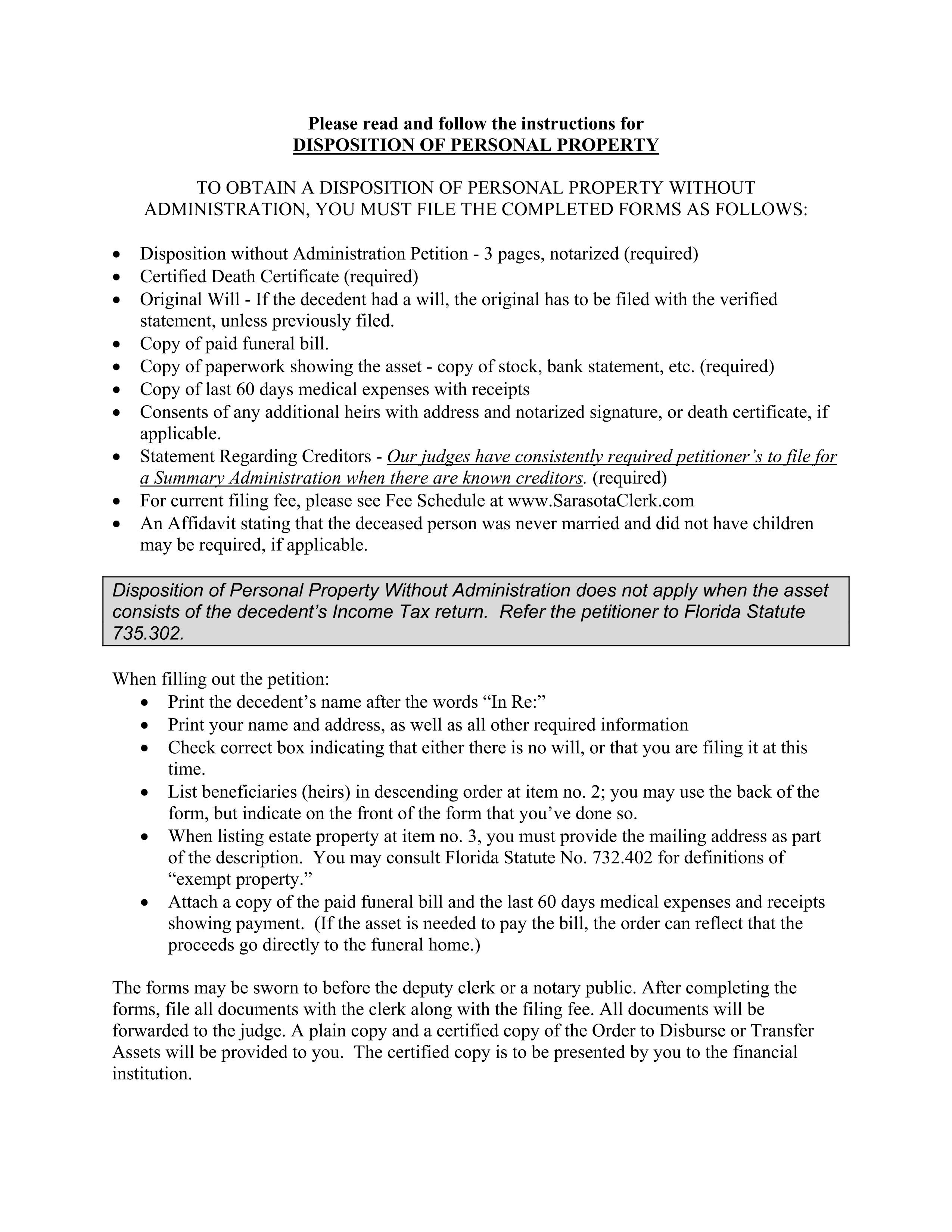

Small Estate Affidavit Instructions in Florida

To file a request to transfer the deceased person's assets to the successors, Florida small estate affidavit form is a compulsory part of it. Along with this form, some other instructions need to be kept in mind to complete transferring belongings.

- Spouse or the Kid: In the presence of the spouse and children of the deceased person, all the assets will be transferred to them without any obligation.

- Include Funeral Bills: The person other than the spouse and the children who paid the funeral and medical bills of the decedent will be paid the amount from the total assets.

- Absence of the Spouse or the Children: If there is no spouse or any child of the deceased, then the heir can apply to get the assets of the deceased predecessor.

- Exempted Properties: The properties that are not included in the total assets of the deceased are home appliances, furniture, and household items.

- Ownership of the Properties: The properties must be only owned by the deceased to transfer them to heirs.

Typical Format of a Small Estate Affidavit in Florida

Florida small estate affidavit form is applicable in the scenarios where the assets are transferred from deceased to successors. This form has a specific format that is needed to be followed, which is stated below.

- The name and residential address are mentioned. If the deceased left a will, it is also stated in the affidavit.

- According to this format, the complete information of the decedent's assets has to be provided with all bank account details. An asset could be a car, boat, bank accounts, insurance money, or an investment account.

- Under the following clause, the affiant writes the unpaid debts by the decedent, whether it is the funeral expense or any medical expense. In this case, the names of the creditors are also mentioned.

- The affiant has to mention the names, age, and contact information of the people eligible to get the decedent's property from the estate.

- All the entitled people will get a notice to inform them about the affiant claiming the deceased person's assets from the estate.

- The last clause ensures that the petitioner is aware of the consequences if the estate knows that the petition is nothing but a false claim.

Checklist before Drafting a Small Estate Affidavit

Florida small estate affidavit is a legal document that allows the successors to get the share in assets of the predecessors after their death. Some of the elements are necessary to be included in this affidavit to complete transferring the assets.

- The petitioner has to wait for some time during this process. This period ranges from two weeks to two months.

- According to the rules and regulations of Florida, calculate the net worth of the assets of the deceased.

- Gather all the documents, including the death certificate and details of the property possessed by the deceased.

- The form is to be created according to the laws of Florida with the list of all the properties owned by the deceased person. This document is required to be signed in front of the deputy clerk who acts as a witness.

- All the heirs of the deceased must be aware of the filing of this affidavit in court. The petitioner can inform all the successors by using certified mail and ask for their acceptance.

- This affidavit is filed in the office of the probate clerk. There is a need to pay a certain amount of fee and all the documents related to the case.

- The request will be accepted or rejected after the processing time of 5 to 15 days. After the acceptance of the file, the assets will be transferred to the heirs.

How to Write a Small Estate Affidavit in Florida

Florida disposition of personal property without administration form creates an easy way for the deceased’s family to get the assets with the permission of the court. This form can be drafted using CocoDoc, an online platform, as it provides all the essential tools to fulfill this requirement.

Step 1: The name of the deceased, the time of the death, and the name of the residing country should be mentioned.

Step 2: The name and contact information of the petitioner should be mentioned in the follow up. It is necessary to mention the relationship of the petitioner with the deceased. Adding the age, recent address, social security number, location, and time of death is a compulsory element of this step.

Step 3: Add the names, complete information, and the relationship of the heirs with the deceased.

Step 4: Include the name and value of the deceased's properties as explained in the will of the predecessor. In this step, all the expenses and debts are also mentioned.

Step 5: The next step is to write the assets to be distributed among the heirs. In case there are other properties or debits, then declare them as well.

Step 6: The final step is to sign the petition in the notary's presence and file the request in the local circuit court.

Conclusion

To conclude, we would say that the small estate affidavit Florida is the best option for the people seeking a way to transfer assets of the deceased. There is no need to get involved in the long sessions of the court; instead, use this form if the value of the assets is $75,000 or less.