It is always a complicated and hassle task to get the assets through the probate processes. The small estate affidavit Oklahoma makes it easier for the beneficiaries to get the property left by the decedent. This is only valid if the dead person has $50,000 or less in the total assets.

The use of small estate affidavit forms limits the long-drawn-out process of the probate court in the state of Oklahoma.

Laws and Requirements in Oklahoma

Oklahoma small estate affidavit lawfully allows an heir to go ahead and collect the possessions of a deceased person. The state of Oklahoma requires the beneficiary to wait for ten days since the death of a decedent. It enables a small estate affidavit if the total amount of the assets is $50,000 or less.

After completing the form with Oklahoma estate law, it can be used to start the collection process of the assets.

Following are the required conditions that must hold to use the small estate affidavit in Oklahoma.

Since the death of a decedent, 10 days must have passed to use the affidavit.

- The total value of the assets should be $50,000 or less.

- The beneficiary must present a valid purpose to serve in the role.

- A personal agent cannot be currently appointed, nor can there be a scheme for an individual to start serving.

- All the taxes and debts regarding a dead person's estate must be accounted for or already paid.

- It may be requested to access any deposit made by the dead person in their credit union or bank account or safety deposit box fixed in a bank or union. There are specific conditions that must be upheld. All of these conditions are outlined in 6 OS § 906.

Judicial Administration of Small Estates in Oklahoma

The state of Oklahoma has a simplified judicial administration for small estates. It started when an heir files a written request with the local probate court demanding to use this procedure where the decedent passed. Without involving in the hoops of regular probate, the court may approve the distribution of the assets.

A written request should always include the following information.

- Details of the Dead Person: This section covers the essential details of the dead person, such as name, age, address, and death date. A relationship with the deceased person should also be mentioned.

- Copy of Will: Attach the certified or original copy of the will and a statement for the proper execution of the will. It can be a statement for the will that has been searched and cannot be found.

- Details of the Creditors and Inheritors: It contains all the relevant information, such as names, ages, and addresses of all the known executors, inheritors, and creditors.

- Description of Property: Include the personal property, real property, values, and legal definition of the legal property.

Later, the court issues notice to creditors and schedules a final hearing. 58 Okla. Stat. Ann § 246.

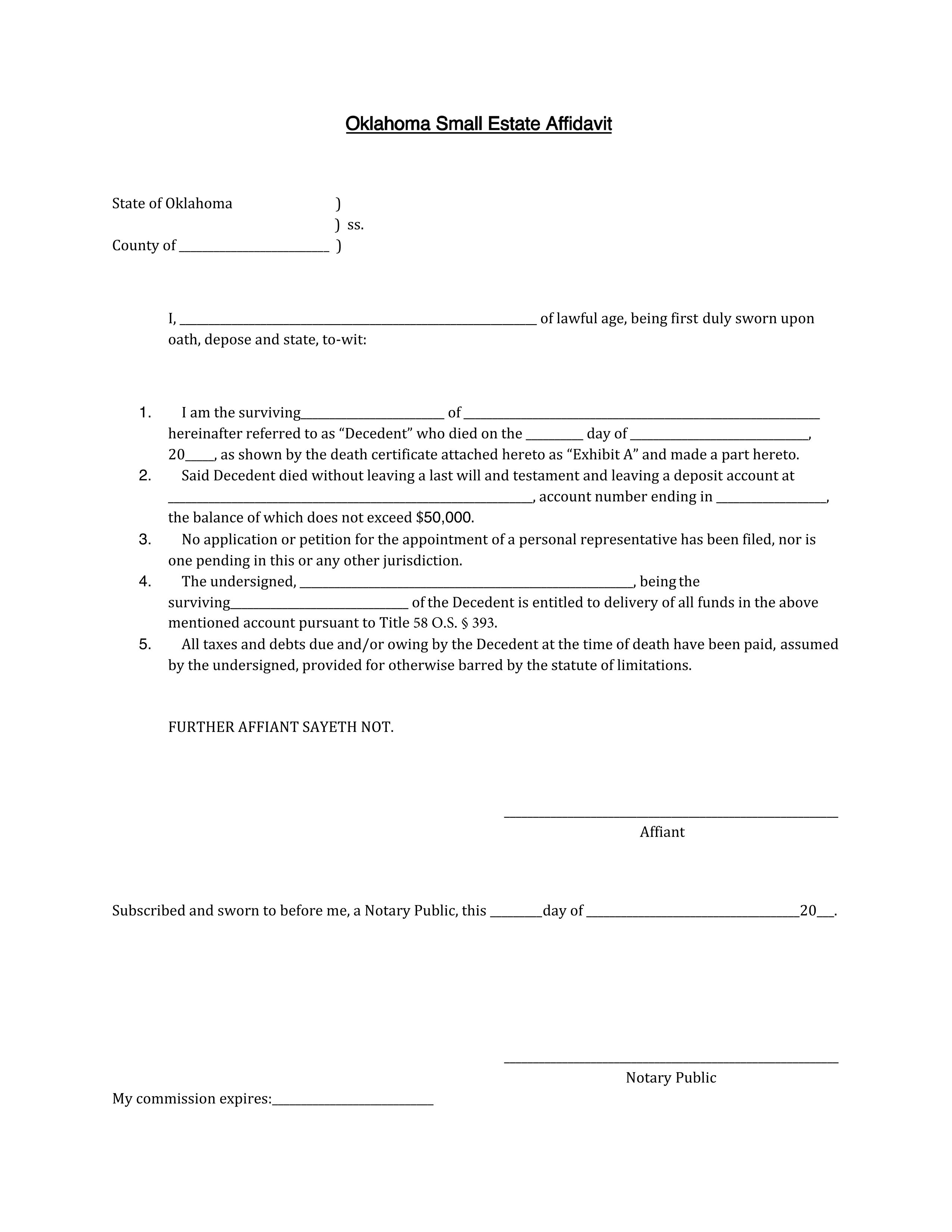

How to Fill Out a Small Estate Affidavit Template

The Oklahoma affidavit of heirship is used when an individual has passed away, and the heirs seek to gather the assets without going through the probate process. The affidavit must be written effectively and concisely to avoid misunderstandings and delays in the whole process. To fill out this form, users can consider adopting an efficient tool under the name of CocoDoc.

The following steps explain how to fill out Oklahoma small estate affidavit form.

- Add the Country: Firstly, add the country in the given space in which the document is being signed.

- Decedent's Details: Write down the name, age, date of death of the decedent, and attach the death certificate.

- Information of the Successor: Mention your name as successor in interest and the relationship with the dead person.

- Account Details: This section includes the name of the bank and the account number you are looking for.

- Names and Signatures: Fill the space for your name and the dead person's name in the section. Then sign and date the affidavit in front of the public officials.

Should A Small Estate Affidavit Be Notarized in Oklahoma

The Oklahoma probate forms need to be filled carefully with all the required information asked in the form. After the filling of the Oklahoma small estate affidavit completely, it must be vowed and signed in the presence of the notary public.

The original or certified copy of the death certificate must also be attached with the small estate affidavit form in Oklahoma. It can be obtained from the local health department for a minimal fee.

The standard court process will take place after the Oklahoma small estate affidavit has been filed. The affiant receives the court's permission to take over the assets of the decedents. All the estate's assets can be distributed after meeting all the claims, either according to the will or with the intestacy's laws, when no will is available.

Conclusion

The small estate affidavit Oklahoma legally allows a surviving beneficiary to a dead person to collect their assets that are currently holding in a bank or credit union. It helps an individual to take all the property without going through the lengthy probate process. After satisfying all the claims, the assets will be distributed to the nominated persons.

This can be effectively covered with the help of a small estate affidavit, which can be followed as displayed in the article.