A small estate affidavit is helpful when an individual wishes to inherit a small estate without reaching court and following a lengthy probate process. Similarly, a small estate affidavit Illinois is a form that helps to transfer an asset to an inheritor after the death of the owner.

The small estate affidavit form allows skipping the lengthy probate processes, which are costly and time-taking. All the estates mustn't exceed $100,000 to transfer to heirs. This is a less expensive and less time-consuming process.

Small Estate Affidavit Instructions in Illinois

The Illinois small estate affidavit provides an efficient way for an heir-at-law of a dead person to distribute and gather the assets of the estate of him. It is simple to use, and once a person has completed it, he doesn't need to file it with the court.

- A person should follow the below instructions before using a small estate affidavit form in Illinois.

- A dead person must not own any real property at the time of death.

- All the other amounts of property do not exceed $100,000.

- A will was filed with the court clerk for the state, in which the dead person lived 30 days before death.

- Any unpaid debts of the dead person, including funeral costs, have to be listed on the affidavit with a promise to pay all of them.

- There are no events of the will or to who should be a beneficiary that you are aware of.

- A person must be either the executor of the dead person's will if there is one or somebody who would inherit through Illinois state intestacy laws if there is no will.

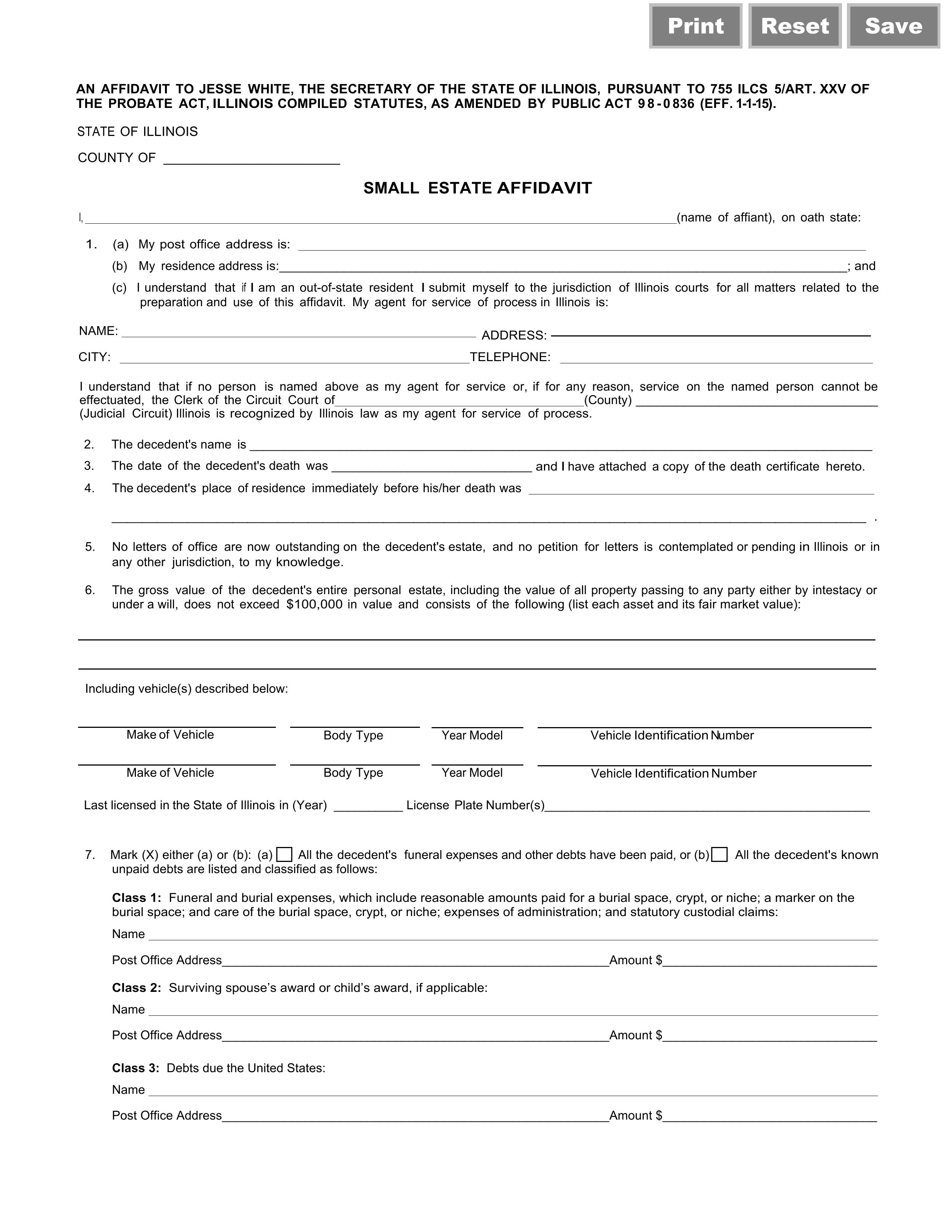

Typical Format of A Small Estate Affidavit in Illinois

The small estate affidavit form must meet specific legal requirements to be valid. Therefore it should contain all the necessary details of a decedent.

Here is the essential information that should be included within every basic small estate affidavit form in Illinois.

- Affiant Details: A small estate affidavit in Illinois should contain the name, address, and contact of the affiant. Mention the relation of an affiant to the decedent.

- Deceased’s Information: The affidavit must include the decedent's name, address of residence, date of death, and the state's name.

- Assets list: Add the detailed list of the assets with their retail value.

- Close Family Relations: Include the names, addresses, and other personal details related to the partners and children.

- Distribution of the Assets: This section contains details about who the remaining assets will be distributed to after any claim payments.

- Verification: At a notary, the affiant must sign the affidavit form and date it.

How to File a Small Estate Affidavit in Illinois

Illinois small estate affidavit form can only be used for personal property, not real property. It should be filled appropriately and executed so that the heir can present this form to a third party to collect the dead person's personal property.

The state of Illinois small estate affidavit must include all the required details under Illinois law, especially the Probate Act of 1975-755 ILCS 5.

- Identify names and addresses: Fill in the County at the top of the form, in which the dead person lived at the time of death. Then write your name as a person signing the affidavit. Enter your residential and mailing addresses in Section 1, and if a person is out of state, then set down an agent who can receive court papers in Illinois.

- Add the Decedent's Details: Write the name, date of death, and residence place of a dead person and attach the death certificate to the affidavit. Mention the vehicles, if any, in the vehicle description as directed.

- Write Debt Information: If there are any unpaid debts of the dead person, they should be added to the affidavit. The debt information can be:

- U.S debts, for instance, tax debts

- Illinois state debts

- Funeral expenses

- Decedent’s employees’ due money

- Spouse or Children’s Information: Add the name and addresses of the decedent’s spouse or children and figure out any award for them. Specify whether or not the dead person left a will.

- Signature: After adding all the required information, sign, and date in front of a notary.

Common Mistakes to Avoid When Drafting a Small Estate Affidavit

Drafting a small estate affidavit in Illinois can be a daunting task. However, interpreting affidavits without the reference of an individual who prepared them is a deceptive practice.

Following is a list of common mistakes that need to be avoided while drafting a small estate affidavit.

- Make a Written Form: Writing an affidavit is valid, but it should not be like that. It is better to have a type-written affidavit form signed by two onlookers to guarantee its validity.

- Not Being Aware of Illinois’ Law: Every states' laws can vary and have their own rules on validity, interpretation, and construction. A single affidavit form is legal in only one state, so it is essential to know the Illinois state law to distribute the decedent's assets successfully.

- Adding Unnecessary Things Within the Form: Make sure the affidavit contains all of the possessions. Some other things such as funeral plans, retirement plans, or life insurance should be left out. Avoid any legal gifts and requests.

- Not Making Significant Amendments: The affidavit form can be changed after the drafting as well. According to the life situations, such as marriage, divorce, business, or children, revise and change the affidavit when needed.

- Writing On Your Own: An individual can draft an Illinois small estate affidavit form, but it is necessary to understand the Illinois state's law that applies to the form.

Conclusion

A small estate affidavit Illinois will allow an individual to skip the lengthy transferring process of assets by probate. An individual can use an affidavit form of Illinois if all the estates have a value of $100,000 or less. It makes the whole distribution process easy and less costly.