People die and leave assets and property for their loved ones that have worth in dollars. However, some cases have more legal complications than assets. It is always essential to solving estate matters by following a legal way.

Louisiana, like other states, has a different approach and procedure of handling property matters and documenting the affidavit of heirship Louisiana. Here, the article recognizes the laws, requirements, and way of documenting the affidavit that obeys the laws in Louisiana state.

Laws and Requirements in Louisiana

It is pretty achievable to transfer the property legally in Louisiana without going to court. However, it is necessary to look upon while drafting an estate affidavit in Louisiana. According to the laws of Louisiana, the affidavit will be further processed if:

- The estate is recognized as a small succession. The value of the decedent estate is $125,000 or less than that.

- The decedent died with or without any will while living in Louisiana or died with a will while being domiciled in any other state.

- The decedent's heirs are their descendants, ascendants, spouses, siblings, or beneficiaries with a will in other states.

If the estate abides by these laws, then the Louisiana small estate affidavit can be composed. However, the affidavit has some requirements regarding the people who must sign it. The requirements include:

- In case the decedent was married, his surviving spouse and adult heir are required to sign the affidavit.

- If he was not married, the affidavit might be signed by two adult heirs. If there is only one heir, anyone with intellect is required to sign the affidavit.

If the decedent's assets include real estate, it must file both the small Louisiana succession affidavit and the decedent's death certificate. Moreover, it must be filed at the place where real estate is situated within 90 days of the decedent's demise.

Judicial Administration of Small Estates in Louisiana

If the estate qualifies for a Louisiana small succession affidavit but fails to be administered by a small succession affidavit, such a case goes to the court. The general rules applied to all successions are also used to the small succession. However, the judicial administration of small estates provides some distinct vital points, which include:

- If the decedent has a home or any other immovable property, the heirs must file an accomplished affidavit with a transference record and applicable mortgage.

- The fees of personal demonstrative and court charges of Louisiana succession are relatively more minor than other succession affidavits.

- The procedures to sell property in small succession is different. The representative is required to commercialize and publish notice of intent in a newspaper of the place where the succession is in process.

- The representative must notify before selling the property. Moreover, the property must be sold out within 10-15 days after publication in a newspaper.

- The signature of the decedent's living spouse is required in the affidavit. In case there is one spouse, the signature of adult heirs is mandatory in the small succession affidavit. In addition to the guardian's powers, they can also sign the document in place of the minor child.

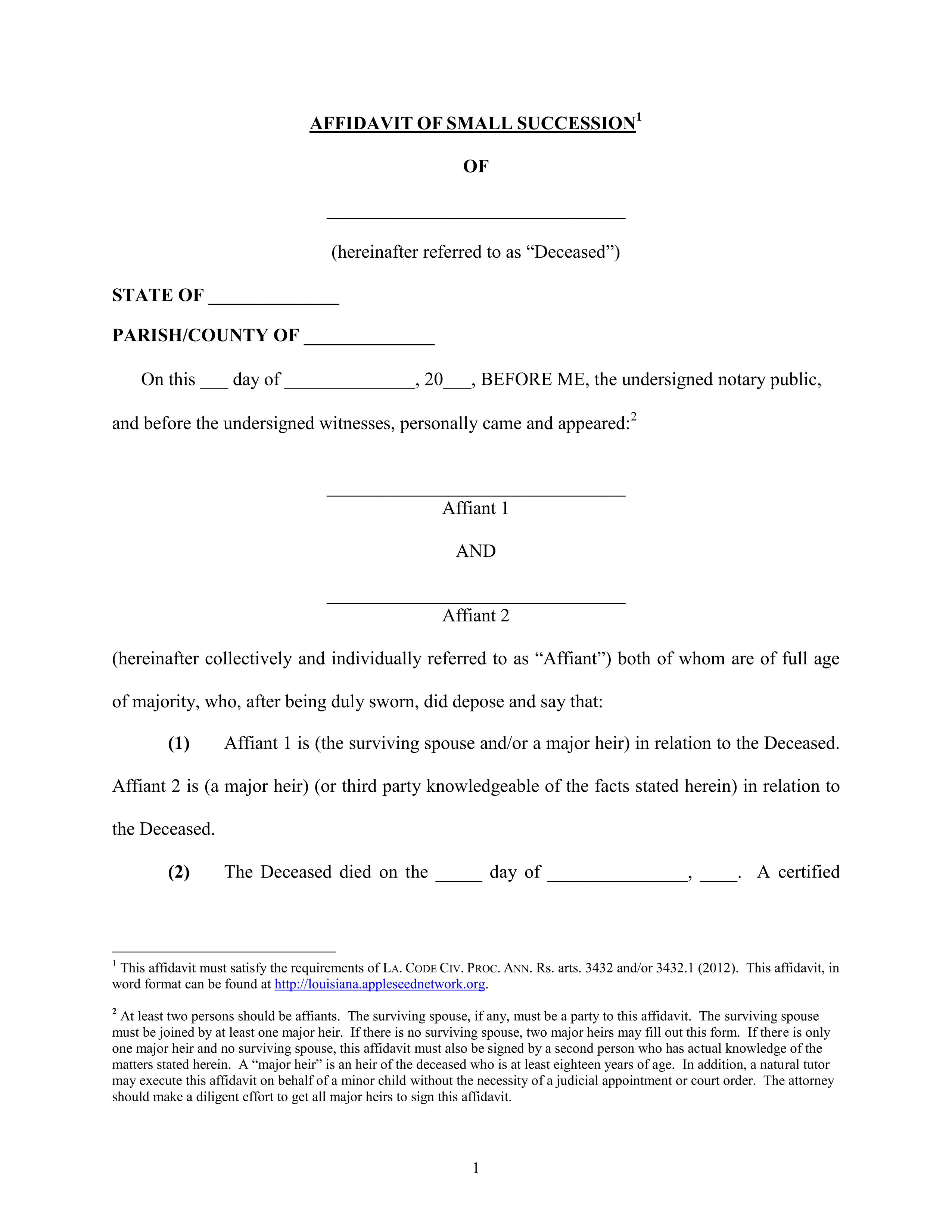

How to Fill Out a Small Estate Affidavit Template

It is essential to draft an affidavit that follows all the rules and regulations. This can be done with the aid of an online tool named CocoDoc. Otherwise, the created affidavit is of no use. The following steps guide on how to fill out the small estate affidavit that follows the legal way.

- Write the full name of the decedent, state, and country name where the decedent was living at the time of death.

- Write the name of two people that have signed the petition. In section 2, write the date of death of the decedent and attach the death certificate. You are also required to fill the residence of the decedent where he passed away.

- In section 5, it is required to mention the marital status of the deceased at the time of his death and his past marital history.

- Section 7 demands to write the names and addresses of adult heirs. Additionally, mention the percentage of assets entitled to heirs of the decedent.

- Section 9 is required to fill the assets of the decedent separately in the description along with its indicated value. Mention the authorization of each asset under the intestacy laws of Louisiana.

- Two affiants, two witnesses along with a lawyer, are required to sign the affidavit. In case of any third party providing the property, an original for the party is required.

- Once the affidavit is provided to the third party (e.g., bank), they can distribute the property per the affidavit's instructions.

Should a Small Estate Affidavit Be Notarized in Louisiana

Once a small estate affidavit is filled and follows all the rules and legal guidelines, the affidavit is then to be sworn publically. The activity takes place in the presence of a local attorney.

It stands as proof that the created form is authentic and does not hold any misleading information. An authenticated copy of the decedent's death certificate must also be filed along with the small estate affidavit. The death certificate can be attained by the health department at an affordable fee.

When the Louisiana small estate affidavit documentation is completed, the legal court proceeds with the small estate supervision. The court allows the beneficiary to take over the property and assets to establish laws under consideration. The court also focuses on the expenses and other costs.

After revising the affidavit and satisfying all claims, the estate's assets are distributed among the successors.

Conclusion

The article explains the laws and regulations that are compulsory to follow while drafting an affidavit in Louisiana. In small successions, the article explains how the judicial procedure with the small estate is carried out. The process of filling out Louisiana succession forms is also described in detail. Furthermore, the article explains the importance of authenticating the affidavit after it is filled.