Every country set their standard amount of small estate. The affidavit process is based on this typical amount. The court will analyze the assets of the deceased one. They will decide whether the deceased’s assets are enough to require a legal confirmation or not.

Like many other countries, Texas has defined the standard amount of assets. After meeting that amount, the assets will be worth called a small estate. When someone passes away in Texas, the ones who claim deceased assets must fill a small estate affidavit form.

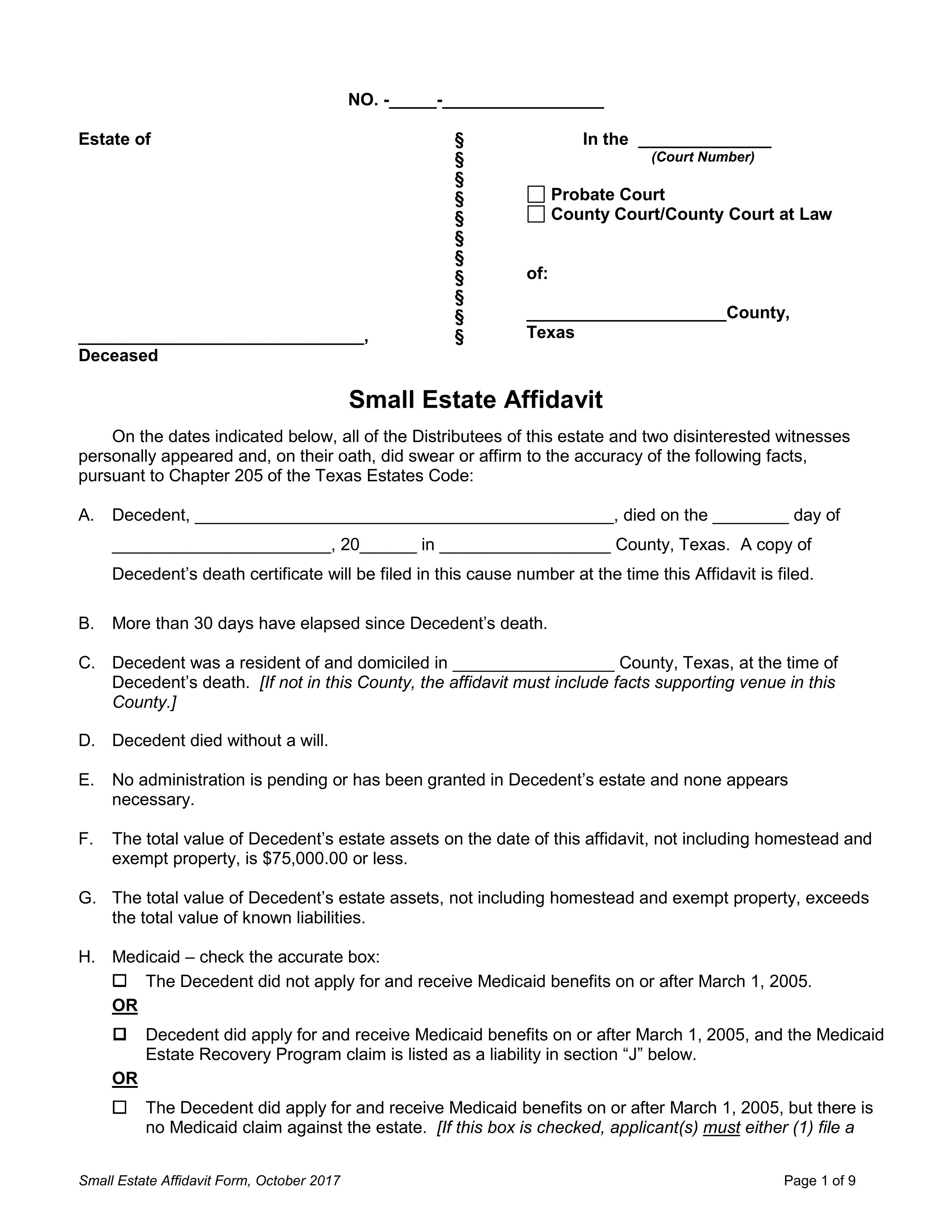

Small Estate Affidavit Instructions in Texas

Some countries provide the public with an opportunity to use small estate affidavits like the Texas government. The heirs of the deceased one’s can use these opportunities to own those assets legally. This small estate affidavit process requires some factual information. These pieces of information are:

- The decedent didn’t leave any will behind.

- There must have been 30 days passed since the decedent passed away.

- There is no other person who is applicable as a personal representative of the estate.

- The standard court amount of small estate is no more than $75,000, excluding exempt property.

- The total known debt is the estate's total non-exempt assets.

A small estate affidavit form is a very effective and efficient way of comforting small estate issues. In a case, if the heirs are the actual owner of the assets, then the affidavit process is not required.

Typical Format of a Small Estate Affidavit in Texas

A format is always necessary to keep things clear and help to make them valid from every perspective. Talking about Texas small estate affidavit form, each country sets its own small estate affidavit forms. Each record is somehow different from the other. Texas typical format of a small estate affidavit forms are:

- Full name and the address of the decedent.

- Complete date of death of the deceased.

- Complete details regarding the asset's decedent hold on.

- All those debts description.

- Names and complete addresses of the distributes.

- Signatures of all distribute.

While filling a small estate affidavit Texas form, the heir must attach an affidavit of heirship. This form might be completed by a third party that has probably no interest in the estate. This form should include:

- Full names and addresses of both witnesses.

- The relationship of the witnesses with the decedent.

- Complete date of death of the deceased.

- The entire martial history of the decedent.

- All family history details such as parents, children, siblings, grandchildren, nieces, and nephews.

Checklist Before Drafting a Small Estate Affidavit

Besides technicalities of the Texas small estate affidavit forms, a checklist which an heir should first go through before drafting the affidavit. These forms are legal documents that anyone can fill on their own. The thing that’s required is, did you enter the correct fields and information in the affidavit? To avoid these types of thoughts, you should check a few things before finalizing the document.

- Fill Out the Small Estate Affidavit Form: The basic information in the decedent section in small estate affidavit forms requires complete details of the deceased person. These details include the name and address of the decedent and his family and relatives.

- Attach Necessary Documents With the Form: The documents that need to be attached with the form are:

- Copy of the death certificate of the deceased person.

- Original or copy of the will, if exists.

- All documents of the deceased property.

- Proof of identity of the heir, like his driving license.

- File the Affidavit with the Court, If Required: The following process of the affidavit is then dependent upon Texas state. All the given documents will be tested, and the decision about the claim on assets will be made.

How to Write a Small Estate Affidavit in Texas

The procedure that is required to write a valid small estates affidavit form in Texas is detailed. There is an online platform named as CocoDoc that is famous for its templates. This platform provides its users to fill a small estate affidavit form in a few clicks.

In Texas, a sequential procedure is followed for valid small estate affidavit forms; that procedure includes some steps discussed below:

- Enter Some Basic Information in the Initial Part of the Form: The first section of the form requires different information about the deceased person in every following line.

- Give a Report Having Property Details of the Decedent: This section will carry the property details of the deceased person. It also includes the information about the distributes and their complete information.

- Description of Liabilities or Debt: The next part contains a table about all the remaining debts on the deceased person. There will be a complete detail of every debit balance in a separate column of the table.

- Provide family history of the decedent: All the detailed information about the decedent's family will be written in this section. The family members could be many according to the rights of every distribution in the family.

- Document Fractional Interests of Each Heir: This area of the form will have the information about the fractional interests that every heir deserves.

- Witnesses' Information: This section will contain the information of the third party that is witnesses. These witnesses have no part in the assets. Other residential details are also mentioned in the form.

Conclusion

People die and leave their earnings or assets to their loved ones. In the present age, Texas allows its people to own these assets legally. Unlike some other states, Texas offers a small estate affidavit form to ease the families from other inconveniences. Moreover, there is an online platform, CocoDoc, which provides you with different templates of small estate affidavit forms.