The probate period is the formal proceeding of the court to transfer the property right after the decedent has passed away. This period can be complex, expensive, and lengthy. However, to tackle this issue, Wisconsin has established a small estate affidavit.

If the worth of all the properties left behind is less than a certain number, Wisconsin has a provision that helps inheritors avoid probate proceedings. A Wisconsin small estate affidavit can help transfer the property without any formal court hearings at all.

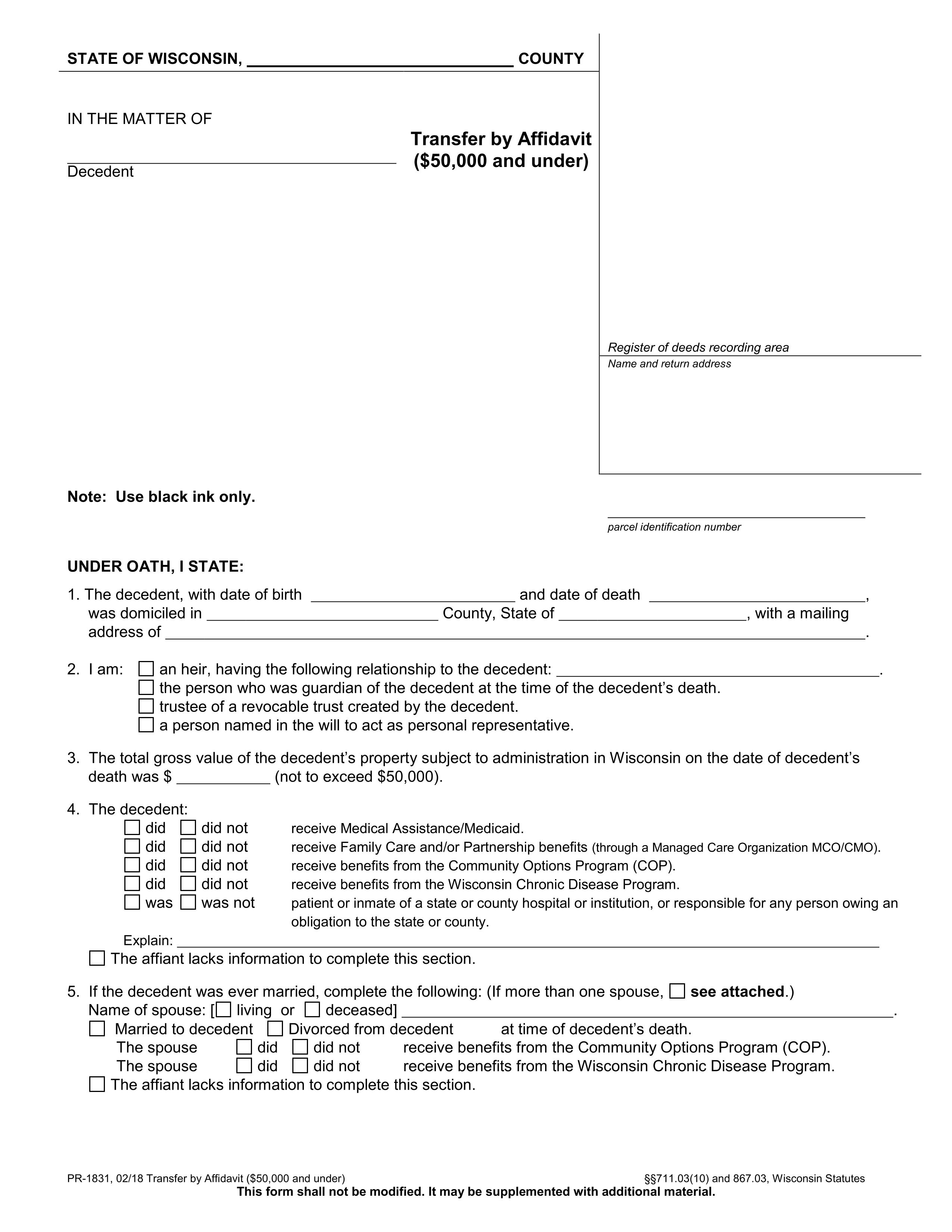

Laws and Requirements in Wisconsin

The Wisconsin Statutes and Annotations govern the small estate affidavit inheritance process. The heirs of the decedent can initiate the affidavit if the value of the property, minus the loan or mortgage, is less than $50,000. To begin the process, the inheritors will submit a drafted brief oath indicating their entitlement to a particular estate. The heirs can file a Wisconsin small estate affidavit to claim assets after a 30-day waiting period.

After a decedent's death, only a valid will can legally transfer possession of the property. The property is divided between the parties in compliance with the decedent's will by the local laws. However, the transfer by affidavit will only apply to the heirs (spouse or children) or any established trust. The heir at law, successor at interest, guardian, or custodian are exempted from this procedure.

The state of Wisconsin requires a payment clearance of a provided care program, medical aid, long-term community support services if not paid. Following any notification about the decedent's death, the Department of Health and Family Services can claim the amount to pay for the remaining charges.

A Simplified Wisconsin Procedure for Small Probate Assets

For small estate affidavit Wisconsin, the procedure is very simplified with almost no court proceedings. This document ensures efficient property transfer by affidavit. The following section details the requirement for the process:

- Any pertinent information about the deceased.

- The names and contact addresses of any descendants.

- The entire transformable property must be described in the document, along with its valuation. Following properties will be exempted from the affidavit:

- Life insurance

- Deeds of transfer on death

- POD (payable on death) bank accounts

- Accounts under a joint name

- Jointly owned business

- Assets allocated in trust funds

- Jointly-owned Vehicles

- A detailed list of all collaterals, including any liabilities, outstanding debts, or other security interests.

- A declaration on whether the deceased person or his or her partner obtained state-funded medical treatment.

- The parties should notify and pay the health services regarding the affidavit for deducting necessary charges over the care given but not accounted for.

- Commitment to obey the local laws governing the asset allocation of Wisconsin.

- Signed affidavit in the presence of notarized people.

Who Can Take Advantage of Wisconsin’s Small Estate Affidavit?

A Wisconsin small estate affidavit is a convenient way to manage a deceased person's estate without having to go through the lengthy procedure of probate court hearings. Following the death, a guardian, successor, or trustee may initiate the transfer by affidavit procedure for property transfer under any appropriate circumstances. This transfer will depend on the will. However, in the absence of a will, the succession plan will still follow the final will, testament, or intestacy rules.

The asset distribution is dependent on the governing laws as well as the inheritors of the assets. It varies on the circumstances of each situation and the estate arrangement in effect. For any guardian and successor, the assets will be transferred in their name by court order. However, a trustee of the decedent's trust will use a transfer by affidavit to transfer assets into the trust.

The affidavit proceeding will address the needs of either party of inheritors. A trustee, beneficiary, or guardian cannot have a complete transfer of the decedent's money or properties. A simplified and expedite procedure will be followed by negotiation about the distribution of the assets. The successor and the trust will get their inherited property by agreeing on assets.

How to Fill Out a Small Estate Affidavit Template

The format of the Wisconsin small estate affidavit must cover all critical data required for the property transfer. Select the template format of the affidavit through CocoDoc, where it can be customized and filled as per the requirement.

Carefully fill out the information, as all the data provided in the document will be under oath. The following are the key steps to be followed while filling out the format:

- Write down the deceased's name and the county of death.

- Carefully mention the information regarding the deceased's birth and death dates, as well as the last known address.

- Indicate connection of the affiant to the deceased. This connection can be of an heir, guardian, or trustee.

- The information regarding the decedent's gross asset valuation will be mentioned in this section. Keep in mind that the probate assets' gross valuation cannot exceed $50,000.

- Mention the details of the deceased was receiving medical treatment before death. It can be family care, community options program, medical aid, Wisconsin Chronic Disease Program, or others.

- Specify the decedent's marital status at the time of death, as well as the spouse's medical condition (if any).

- Specification regarding the assets that would be subject to a change of title and their worth.

- As a sign of your approval, include your signature along with the date of the affidavit submission.

- The affidavit must be notarized by notary public signature, and deeds must be recorded.

Complete the Wisconsin transfer by affidavit with the state seal and email it to the Department of Health Services (Estate Recovery Program). The financial institution holding the property must also be issued a copy of an affidavit to finish the transfer process.

Conclusion

The Wisconsin small estate affidavit has a straightforward and guiding procedure. This article details complete information regarding the small estate affidavit Wisconsin. It will help better understand the process and save a significant amount of time and money in probate cases.

By using the provided template of CocoDoc, the transfer of affidavit can be more convenient and streamlined.